MyFO has received investment through Rhino Ventures, the Vancouver companies recently announced.

Family offices and ultra-high-net-worth individuals manage trillions of dollars—more than the entire hedge fund industry. The number of family offices has tripled since 2019 to more than 10,000 worldwide.

Despite this scale, management of these assets is often riddled wth inefficiencies, argues MyFO.

Wealth management today is fragmented and cumbersome, the startup believes, with critical financial documents and data scattered across various platforms and storage solutions. The process can prove daunting for many users.

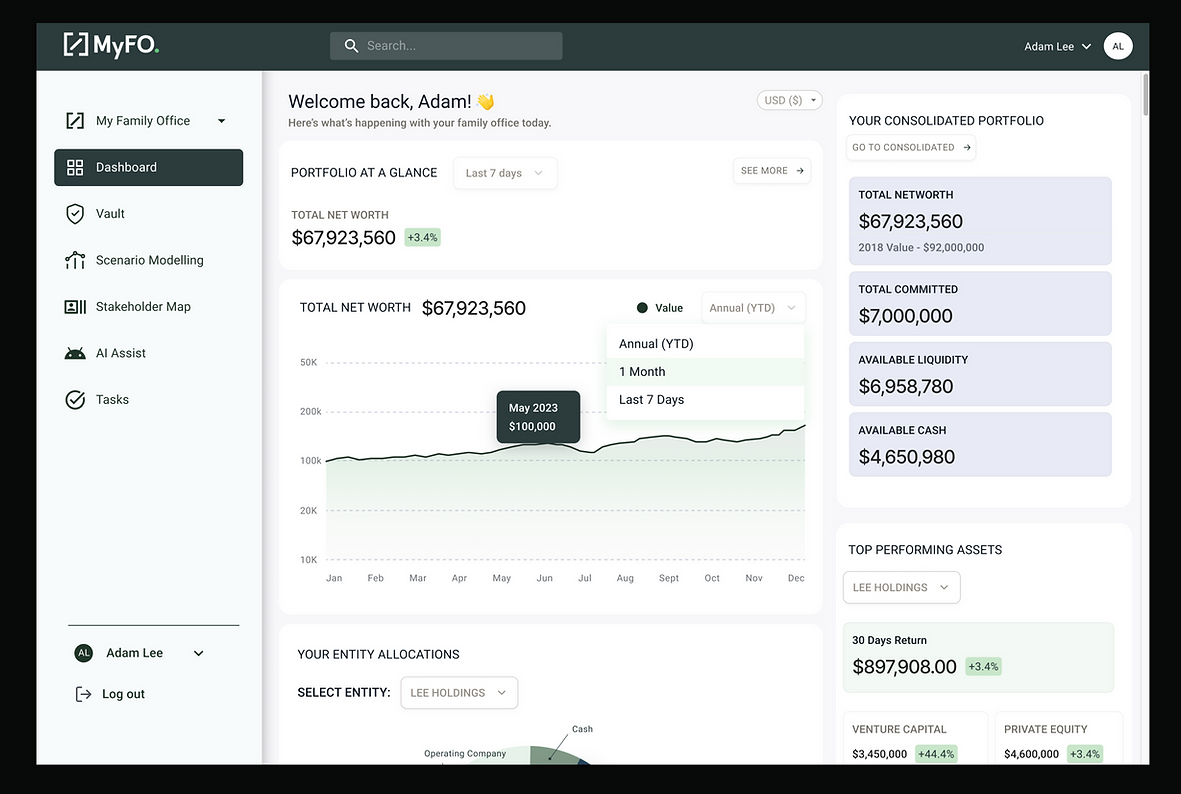

MyFO’s aim is to streamline wealth management through A.I. and other modern technologies, consolidating information and tools in one place to ensure every generation is well-prepared and can properly navigate their financial future.

Tools include asset consolidation, data reporting, and scenario modelling.

Joining Rhino’s crash with a C$4.8M investment, MyFO is a “transformative force in the family office ecosystem,” according to the venture capital firm. The platform is positioned to bring efficiency, transparency, and scalability to an underserved market.

MyFO was founded by Simran Kang, who serves as chief executive officer, and CRO Jonathan Ricci.

The startup was established in 2021 after Kang, herself a founder of a family office, experienced firsthand the rigidness and complexity of legacy solutions.

Including a prior pre-seed round, MyFO has now raised a total of nearly $7M.

Rhino is a local venture capital firm that has invested overseas as well as in regional upstarts—Thinkific, for example, went public in 2021 at a unicorn valuation after raising a total of $50 million from Rhino Ventures.

Leave a Reply