Investors on Vancouver Island are taking a page out of Warren Buffet’s old playbook.

“If you own a Canadian business, there’s a vital reason why you should consider selling,” Andrew Wilkinson, cofounder of Tiny Foundation, posted recently on X. “By June 25, the capital gains tax on the sale of your business will soar.”

Wilkinson is referring to Canada’s new federal budget, which threatens to further tax innovation and entrepreneurship across the country.

“The Federal government just announced that it is increasing the capital gains inclusion rate from 50% to 66.67% on June 25, 2024,” Wilkinson wrote. “That means that, if you sell your business for $10,000,000 and you are in the high income tax bracket, you will pay $3.3 million of taxes instead of $2.5 million.”

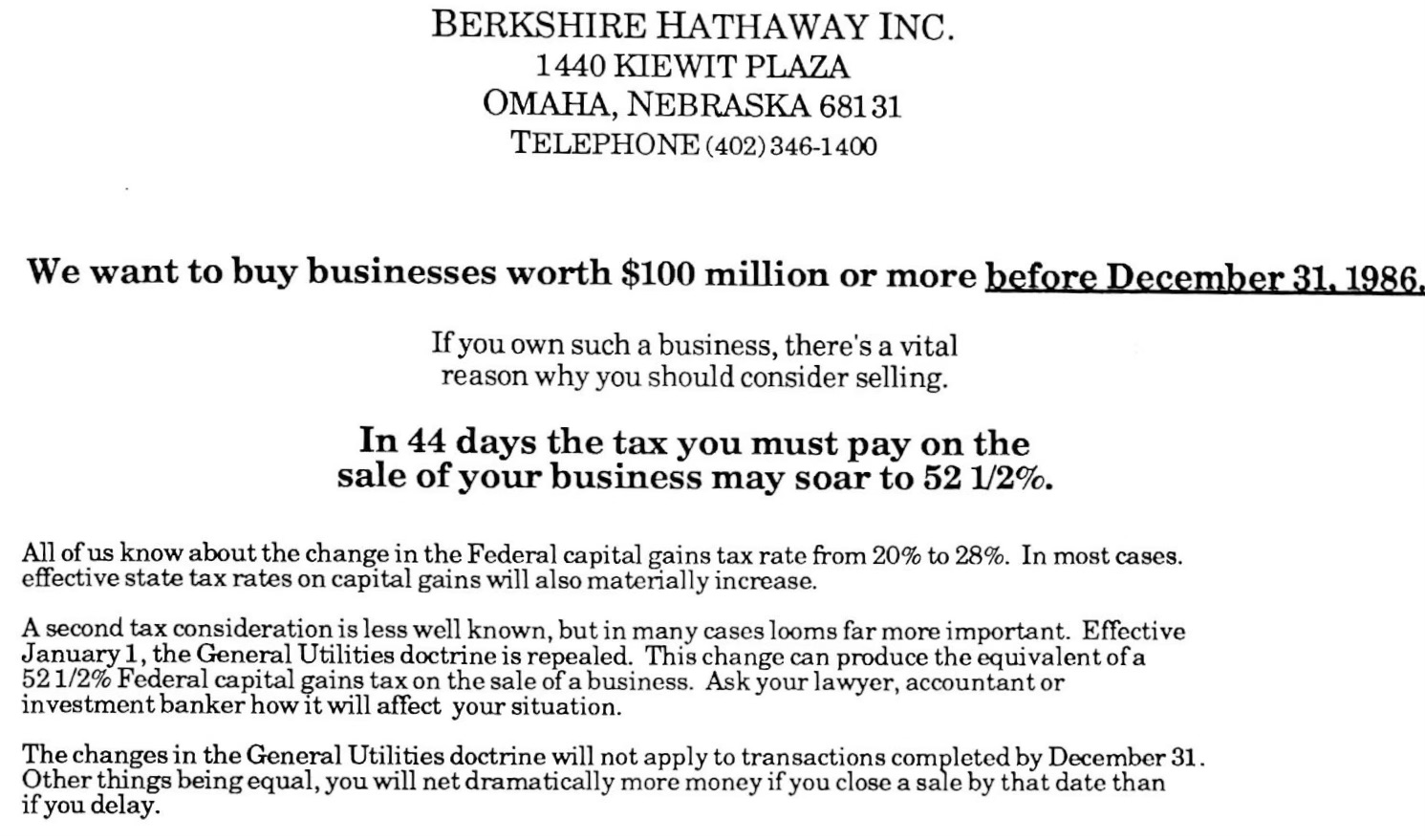

The X post mimics a Berkshire Hathaway document from the 1980s, which laid out a similar proposition: citing forthcoming capital gains tax raises, Buffet offered to buy businesses “with extraordinary speed” ahead of the implementation.

“Other things being equal,” Buffet wrote in 1986, “you will net dramatically more money if you close a sale by that date than if you delay.”

Tiny, a holding company founded in 2007 by Wilkinson and Chris Sparling, is seeking firms with $1 million in annual profits and a “history of consistent performance,” among other requirements.

Last year, Tiny went public on the TSXV through a reverse merger with WeCommerce, which had been trading publicly since 2020.

Based in Victoria, Tiny has launched 11 companies (including WeCommerce), and is a majority owner of more than three-dozen firms (such as New York’s HappyFunCorp) on top of nearly 100 minority investments.

With a head office team of fewer than 20 on the island, Tiny employs more than 900 workers worldwide through its portfolio.

Leave a Reply