Earlier this year Vancouver’s Wishpond launched Wishpond Payments, a new service enabling the company’s 2,000+ customers to sell and collect payments directly through landing pages.

The new product release continued the marketing suite’s flywheel momentum after it became a publicly-listed company on the TSX Venture Exchange in late 2020.

Wishpond has wrapped up their first quarter as a public company with record revenue and a strengthened balance sheet thanks to an over-subscribed $8 million equity offering.

“First quarter 2021 was a historic quarter for Wishpond as it was the first full quarter since becoming a publicly listed company. During the quarter we achieved record revenue, completed our first two acquisitions and raised over $8.0 million through a bought deal equity offering.” said Ali Tajskandar, Wishpond’s Chairman and CEO.

“I am very pleased with our first quarter results in which we accomplished year-over-year growth of 74% compared to the same period last year. First quarter results were driven by strong organic growth in the quarter and contributions from the acquisitions of Invigo and PersistIQ.”

Tajskandar reported that at the end of March 2021, Wishpond achieved $1.2 million in monthly recurring revenue (MRR) setting the stage for strong financial results for the second quarter.

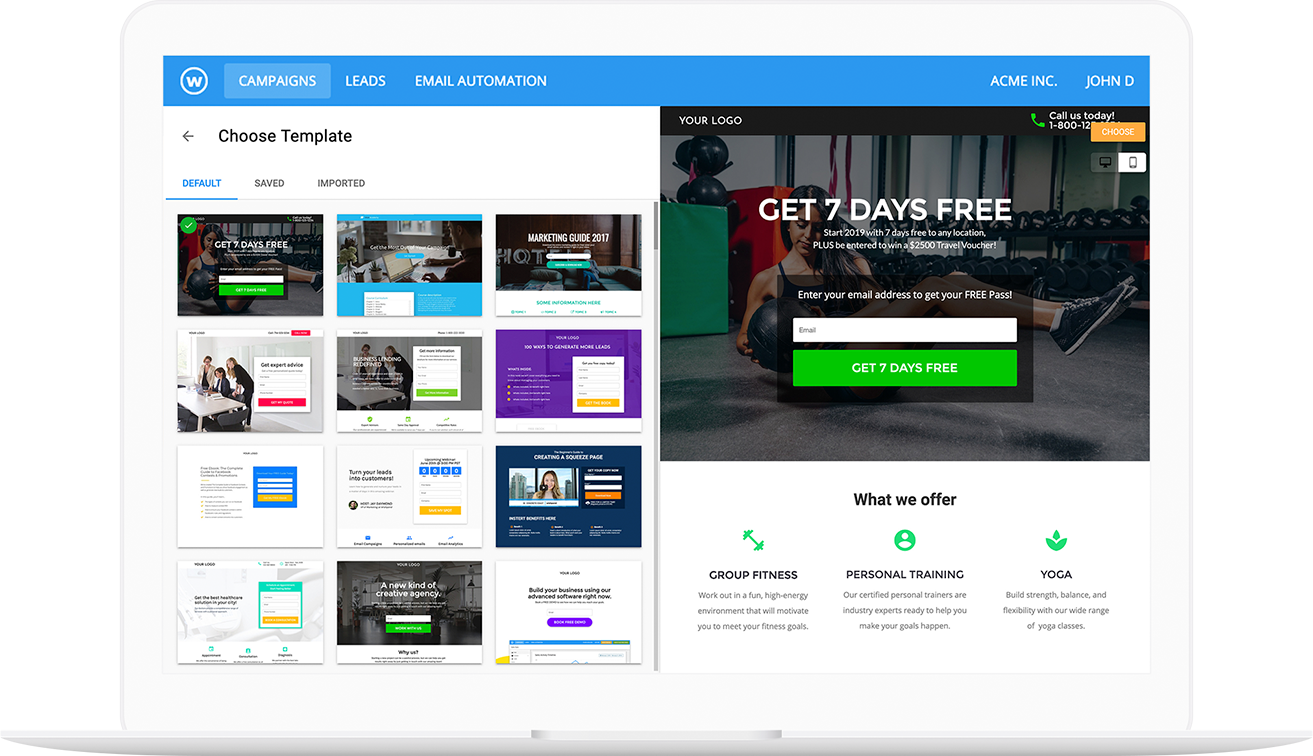

Wishpond offers an “all-in-one” marketing suite that provides companies with marketing, promotion, lead generation, and sales conversion capabilities from one integrated platform. Wishpond replaces entire marketing functions in an easy-to-use product, for a fraction of the cost.

Leave a Reply